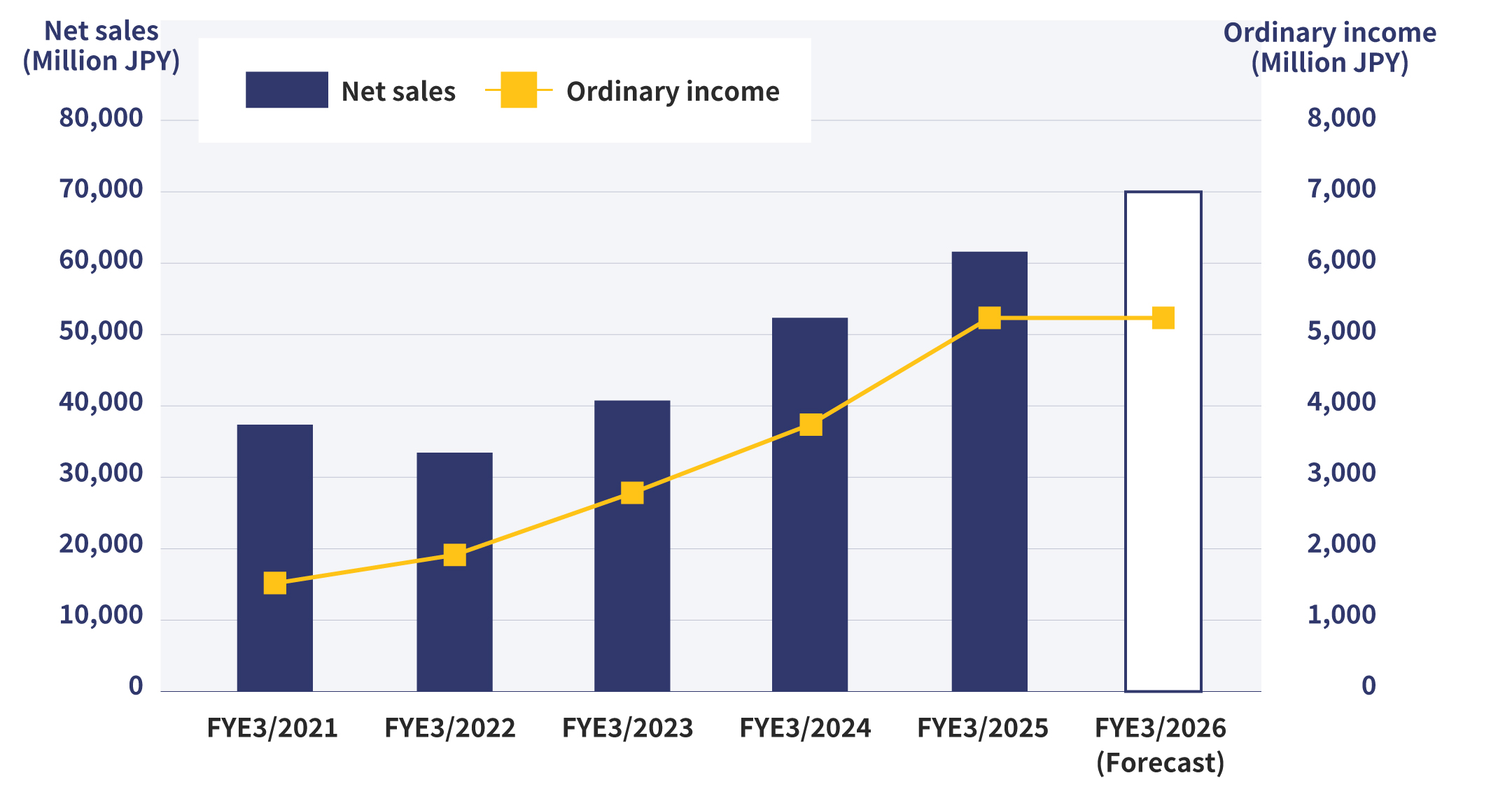

Consolidated Financial Forecast

Financial Forecast for FYE3/2026 (April 2025 – March 2026)

The Japanese economy is expected to continue to recover at a moderate pace due to the increase in inbound demand, growing personal consumption, and the improving employment and income environment. On the other hand, the outlook for the Japanese economy is expected to remain uncertain for some time due to concerns about downside risks to the economy from the impact of U.S. policies and changes in the financial and capital markets.

In such an environment, the Company will promote coordination with its group companies around the world in order to cope with any major changes in the economy. The Company will also work to capture growing demand to achieve further growth in each business segment while actively working to develop new business fields. In addition, we will focus on addressing our management issues of strengthening management foundation and sustainability initiatives in order to support these efforts and work to achieve sustainable growth and corporate value enhancement over the medium to long term.

For the fiscal year ending March 31, 2026, the Company anticipates a continued expansion in orders for amusement rides both domestically and internationally, as well as steady demand for temporary stage equipment in the stage equipment segment. Based on these trends, the Company forecasts the following consolidated financial results.

(Million JPY)

| FYE 3/2025 (Actual) | FYE 3/2026 (Forecast) | |

|---|---|---|

| Net sales | 61,861 | 70,000 |

| Operating income | 4,797 | 5,000 |

| Ordinary income | 5,293 | 5,300 |

| Net income attributable to owners of parent | 2,995 | 3,200 |